Social Security offers surviving family members two types of benefits when someone dies. The official Social Security death benefit is just a small one-time $255 payment. But Social Security's survivor benefits are much more important, providing family members with monthly payments that in some cases last the rest of their lives.

How can you get a $255 Social Security death benefit?

The National Technical Information Service (NTIS) established a certification program for those seeking access to the Limited Access Death Master File (LADMF) pursuant to Section 203 of the Bipartisan Budget Act of 2013 (Pub.

If you're a surviving spouse or child, you can receive a $255 lump-sum death benefit if you meet certain eligibility requirements. A surviving spouse who was living in the same household with the worker when the worker died automatically gets the death benefit. Even if they were living apart, the surviving spouse can still get a payment if he or she was already getting benefits on the worker's work record or became eligible to do so when the worker died.

- The SSA Death Master File is comprised of decedents with social security numbers whose deaths were reported to the Social Security Administration. The SSA reports that in most cases a report of death was made in connection with a claim for Social Security death benefits.

- We compile this death information, known as the Death Master File (DMF). The DMF is an extract of death information on the NUMIDENT, the electronic database that contains our records of Social Security Numbers (SSN) assigned to individuals since 1936, and includes, if available, the deceased individual’s SSN, first name, middle name, surname.

Image source: Getty Images.

If no spouse is eligible for the death benefit, a child can get it if he or she was receiving benefits on the worker's record or became eligible to do so at the worker's death. If no one qualifies to receive the payment, then the death benefit goes unpaid.

Qualified recipients who are already getting benefits will typically receive the death benefit automatically. Those who aren't receiving benefits right now need to apply for the payment within two years of the date of death.

Why survivor benefits are much more important

The official Social Security death benefit is just a token payment a family member can receive. By contrast, the survivor benefits that take effect at a loved one's death are substantial and last a lot longer. For survivor benefits to take effect, the deceased worker must have worked long enough to earn a certain number of Social Security credits. That number varies depending on the age of the worker at death, ranging from as few as six to as many as 40.

For surviving spouses, survivor benefits are often a financial lifeline. To qualify, the spouses must have been married for at least nine months prior to death, with exceptions applying for those who have children together or in cases of accidental death or death during military duty. Benefits can typically kick in once a surviving spouse reaches age 60, and younger spouses can also get survivor benefits if they're caring for a child who is under the age of 16. For those spouses who qualify based on a child, benefits stop once the child reaches 16, but then start up again when the spouse chooses to take them after turning 60.

Children can also be eligible for survivor benefits. To qualify, the child must be under 18, or in high school and no older than 19. Children who aren't disabled stop getting benefits once they no longer qualify due to age. However, disabled children have no age limit, as long as they became disabled before turning 22.

Even divorced spouses can get survivor benefits if they qualify. The spouses must have been married for at least 10 years, and the surviving spouse must not have remarried before reaching age 60.

How much will Social Security pay in survivor benefits?

Survivor benefits are based on the retirement benefit that the deceased worker either already received or would have received at retirement. The base amount is determined taking into account any addition to or subtraction from the worker's benefit resulting from the age at which the worker claimed Social Security. So if the deceased worker claimed Social Security early at age 62, then the base amount will be less than if the worker had waited until full retirement age.

Once that base amount is determined, Social Security applies any reduction based on the surviving spouse's timing of when to claim benefits. Those who wait until full retirement age get the full base amount, but if survivors claim early, then reductions apply. A 28.5% reduction applies to those who take benefits at 60, so if you would have gotten $1,000 per month at full retirement age, you'd only get $715 per month in survivor benefits if you take them starting at age 60.

Spouses who haven't yet turned 60 but are caring for a child under 16 get 75% of the base amount of the worker's benefit. Eligible child survivors also get 75%, subject to a maximum total family amount that typically ranges from 150% to 180% of the worker's base amount.

One key element of survivor benefits is that you can file for them independently from your own retirement benefit. Once you've applied for both, you won't get the sum of both -- instead, you're only entitled to receive whichever is larger. But one lucrative strategy can be to take either your own benefit or your survivor benefit early, and then change to a larger benefit later on. That way, you can get the best of both worlds.

How to learn more about Social Security death benefits

The Social Security Administration website has more information about both of these benefits. There is a page that talks about the Social Security death benefit, while survivor benefits are discussed here. There, you'll get more detailed information about how to qualify, how much you'll receive, and how you can apply online for benefits.

Social Security's benefits after death provide financial security to your loved ones. By knowing how they work, you'll be in a better position to manage your finances no matter what happens.

One of the federal government's most effective weapons against financial fraud, identity theft -- and now terrorism -- is a massive database of dead people grimly known as the 'Death Master File.'

Produced and maintained by the Social Security Administration (SSA) and distributed by the National Technical Information Service (NTIS), the Death Master File is a massive computer database containing more than 85 million records of deaths, reported to Social Security, from 1936 to present.

How Crooks Use Dead People

Assuming the identity of a dead person has long been a favorite ploy of criminals. Everyday, living bad people use the names of dead people to apply for credit cards, file for income tax refunds, try to buy guns, and any number of other fraudulent criminal activities. Sometimes they get away with it. More often, however, they are foiled by the Social Security Death Master file.

State and federal government agencies, financial institutions, law enforcement, credit reporting and monitoring organizations, medical researchers and other industries access the Social Security Death Master file in an effort to prevent fraud -- and since the Sept. 11 terrorist attacks -- comply with the USA Patriot Act.

By methodically comparing applications for bank accounts, credit cards, mortgage loans, gun purchases, and other applications against the Death Master File, the financial community, insurance companies, security firms and state and local governments are better able to identify and prevent all forms of identity fraud.

Fighting Terrorism

Part of the USA Patriot Act requires government agencies, banks, schools, credit card companies, gun dealers, and many other businesses, to make an effort to verify the identity of customers. They must also maintaining records of the information they used in verifying customers' identity. Those businesses may now access an online search application or maintain a raw data version of the file. The online service is updated weekly and the weekly and monthly updates are offered electronically via web applications, thus reducing handling and production time.

Other Uses for the Death Master File

Medical researchers, hospitals, oncology programs all need to track former patients and study subjects. Investigative firms use the data to identify persons, or the death of persons, in the course of their investigations. Pension funds, insurance organizations, Federal, State and Local governments and others responsible for payments to recipients/retirees all need to know if they might be sending checks to deceased persons. Individuals may search for loved ones, or work toward growing their family trees. Professional and amateur genealogists can search for missing links.

What Information is on the Death Master File?

With records of over 85 million deaths reported to SSA, the Death Master file includes some or all of the following information on each decedent: social security number, name, date of birth, date of death, state or country of residence (2/88 and prior), ZIP code of last residence, and ZIP code of lump sum payment.

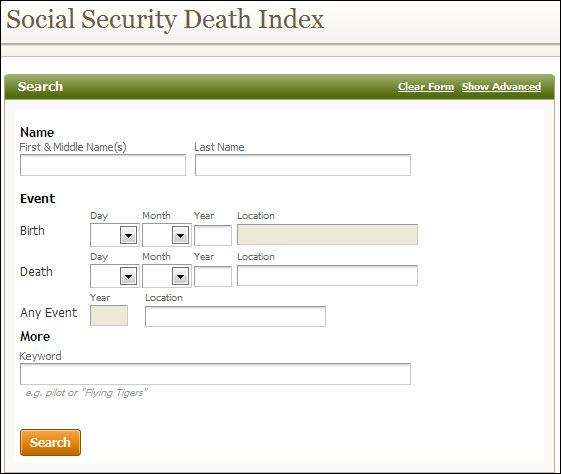

Ss Death Master File Social Security Security

Since Social Security does not have the death records of all persons, the absence of a particular person from the Death Master file is not absolute proof that the person is alive, notes the Social Security Administration.